KVANTOR is a decentralized gateway or platform that provides financial links with business partners, by opening new payment channels and eliminating intermediaries and the KVANTOR Platform aims to upgrade the agreement to a new level and provide freedom of relationships between economic entities, beyond traditional payment channels and eliminate intermediaries.

The KVANTOR project is to provide real freedom to global market economic agents or to be a new level of freedom for future economic transactions.

- to use sophisticated residential technology;

- to make quick transactions for competitive and acceptable prices that are not controlled by cartels and companies;

- to reduce costs for the clerks, lawyers, «contract management specialists» and release many unnecessary documents;

- to transfer capital simultaneously (in many cases, automatically) to those development points, which provide the greatest advantage with minimal risk.

This platform will allow for reduced delivery time to minutes, transaction expenses and error risk - almost to zero, and the volume of required documents - down to the barest possible.

By using KVANTOR, currency and commodity exchange will be able to provide services to their clients based on future technology, and banks will become not only financial institutions but full business partners. We create instruments for the establishment of an equivalent eco-system ecosystem (from physical entities to transnational corporations) that have no entry barrier, provide participants with a win-win work model and erase economic and political limits but do have the highest level of data protection.

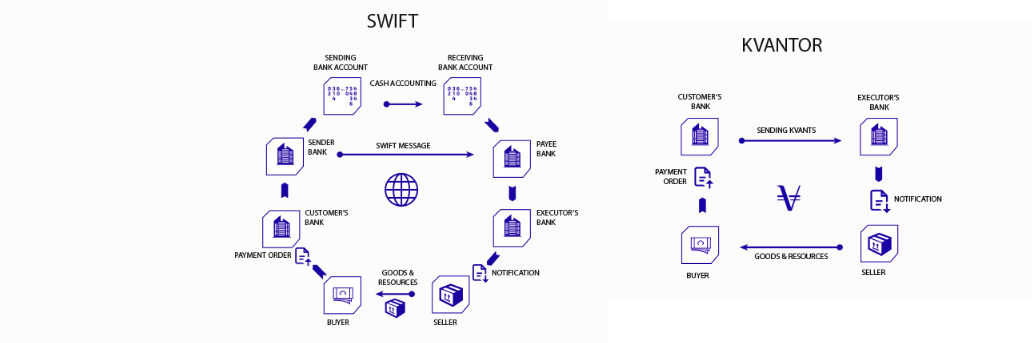

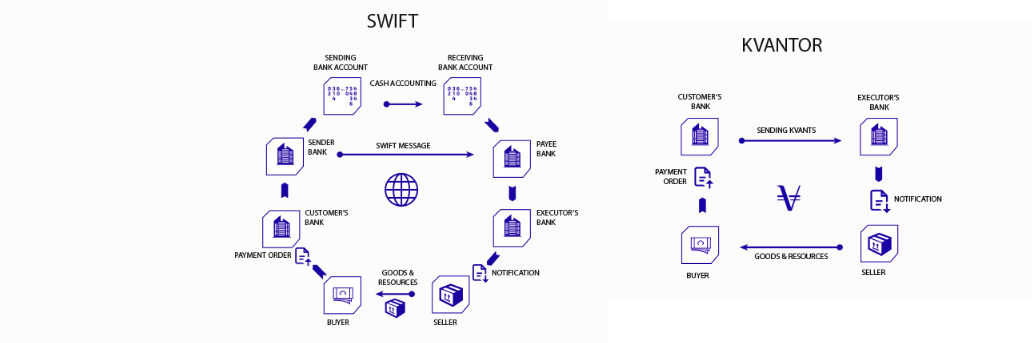

This platform is designed to provide full confidentiality of transactions (only parties involved in transactions are allowed access to information), as well as quick and secure settlement without SWIFT.

The project was developed by a team of professionals, based on their own experience and the international experience of the specialists. Our task is to create products that enable both individual companies and all countries to free themselves from their dependence on existing external external economic and financial controls, but not in violation of local laws or laws of the partner's country of residence.

The platform is implemented as SaaS and as a "box" solution. The SaaS format allows system participants to interact freely, make payments almost instantaneously, and ensure the implementation of obligations through smart contracts. The box solution is represented as a stand-alone system with the ability to connect to a global platform via a convenient, broad API.

Interbank transfer

Interbank transfers provide channels to banks to exchange messages about current transactions between participating banks.

All transaction data is stored in the KVANTOR blockchain, which provides the required transaction processing speed and protection against logical attacks directed at the network.

The message exchange mechanism of the program is based on the legally significant functionality of electronic document management, which relates to the legislation of countries in which KVANTOR ecosystem participants live.

The software mechanism is installed in the bank and interacts with the ABS bank via a special API. The message exchange process occurs on an encrypted channel.

All money transfers are implemented using a protocol that is compatible with the SWIFT system, which allows to minimize changes in the existing ABS.

Commodity Exchange

The exchange of commodities allows users to transact with raw materials, insure them, organize transportation, prepare all necessary documents, receive financial instruments (warranties, loans, etc.) and make instant payments with monetary instruments (fiat or digital) through convenient channels SWIFT).

Actual transaction and implementation controls are performed using smart contracts.

In addition to transactions with raw material suppliers, this platform enables simultaneous transactions with complementary service suppliers (transport and insurance).

In addition to transactions with raw material suppliers, this platform enables simultaneous transactions with complementary service suppliers (transport and insurance).

Platform technology allows the realization of a number of units simultaneously in a single system (ruble, yuan, tenge, and others).

Features of the exchange are available for fiat currency procedures, online transaction protection using an eskro account with the convenience of allowing the exchange interface.

More about KVANTOR, watch the video below:

KVANTOR Tokens Emission Rules

Token standard: ERC20.

Initial number of KVANTOR tokens: 100,000,000 pcs.

The initial value of the KVANTOR token token is 1/1,300 of the value of an ounce of gold on the day of the smart contract creation (tokens release) and is determined by the daily exchange rate in the London Interbank Market11 in USD, EUR, GBP with one decimal point. The rate of purchase in other currencies is determined by the cross rate of the currency exchange chosen before the beginning of ITO12 to GBP at the date of the token purchase.

Initial number of KVANTOR tokens: 100,000,000 pcs.

The initial value of the KVANTOR token token is 1/1,300 of the value of an ounce of gold on the day of the smart contract creation (tokens release) and is determined by the daily exchange rate in the London Interbank Market11 in USD, EUR, GBP with one decimal point. The rate of purchase in other currencies is determined by the cross rate of the currency exchange chosen before the beginning of ITO12 to GBP at the date of the token purchase.

After completion of ITO, all transactions with KVANTOR tokens are frozen for 2 months.

Bounty campaign

Bounty campaign is carried out. All the official announcements on bounty campaign will be posted on the official blog and on the website.

Bounty campaign is carried out. All the official announcements on bounty campaign will be posted on the official blog and on the website.

Pre-ITO and ITO

Distribution of released tokens:

- 15% - founders, team, initial beneficiary

- 5% - partners of the project

- 80% - beneficiaries of the KVANTOR project, including:

- 20% of released tokens are intended for sale in the 1st round of sales;

- 40% of released tokens are intended for sale in the 2nd round of sales;

- The remaining 20% of issued tokens are reserved for subsequent sale (the possibility of exchange trading or selling to a strategic beneficiary will be considered).

Soft Cap - The Soft Cap is 3,000,000.00 GBP. Alongside with the ITO activities, the company is seeking to raise money from venture funds and individual investors.

Hard Cap - equivalent of 32 million GBP. According to our current business plan, this amount (taking into account the costs of system development, marketing, promotion, etc.) will allow the project to recoup the borrowed funds within the required period and start making profits.

- Pre-ITO - not carried out.

- ITO - is held in three rounds.

1st round of sales

From 26.04.2018 to 25.05.2018 - 20% of KVANTOR tokens are sold. Within this phase, the tokens are sold under a private pre-order (Private Token Sale). Tokens can be purchased by sending an e-mail to ceo@kvantor.com.

From 26.04.2018 to 25.05.2018 - 20% of KVANTOR tokens are sold. Within this phase, the tokens are sold under a private pre-order (Private Token Sale). Tokens can be purchased by sending an e-mail to ceo@kvantor.com.

Based on the analysis of interest in the project by potential beneficiaries, the project team either continues the main sale in the Private Token Sale format or begins an open subscription to the tokens.

2nd round of sales

From 25.06.2018 to 24.07.2018 - 40% of KVANTOR tokens are sold.

From 25.06.2018 to 24.07.2018 - 40% of KVANTOR tokens are sold.

3rd (additional) round of sales It is held not earlier than 3 months after the end of the 2nd round.

Discounts

- A 40% discount on the nominal value of the token is provided in the 1st round of sales.

- A 20% discount on the nominal value of the token is provided in the 2nd round of sales.

- Discounts are provided in case of high volume purchase:

=>5,000 - 24,999 KVT (25% of token nominal value)

=>25,000 - 49,999 KVT (27% of token nominal value)

=>50,000 - 249,999 KVT (30% of token nominal value)

=>250,000 - 499,999 KVT (35% of token nominal value)

=>500,000 KVT (40% of token nominal value) - Discounts are not provided in the 3rd round of sales on a regular basis.

- Minimal purchase package is 100 tokens.

Roadmap

2018

Q2

- The core sales and development team is formed. Top, middle, and bottom management are recruited

Q3

- Team building is complete

- Kvantor goes into all major technology partnerships

- Basic methodological and technological introduction of Kvantor platform development

Q4

- Strategic regional partners are defined

- Beta of the Settlement Service

2019

Q1

- Commercial version of the Interbank Settlement Service was released

- Agreements with strategic regional partners are ensured

- Supporting infrastructure is established

Q2

- The first contract for the provision of the Interbank Settlement Service is signed

Q3

- Beta of the Bank Service Pack is released

Q4

- Major regional clients are assigned

- Beta of the Exchange Rate Trading Service was released

- Commercial version of the Bank Service Pack is released

2020

Q1

- Commercial version of the Bank Service Pack is released

- The first contract for the provision of the Bank Service (from the Bank Service Pack) is signed

- The Client Consortium with the aim of obtaining input from customers and facilitating strategic planning for the development of established platforms

Q2

- Beta of the Exchange Rate Trading Service was released

Q3

- The commercial version of the Exchange Rate Trading Service was released

- The first contract for the provision of the Exchange Rate Trading Service is signed

Up here explanation from me and to avoid all forms of fraud please look for accurate and reliable information or visit the Link I provide below:

WEBSITE: https: //kvantor.com/

WHITEPAPER: https://kvantor.com/docs/whitepaper_en.pdf

FACEBOOK: https://www.facebook.com/kvantorcom

TWITTER: https://twitter.com/kvantor_com

TELEGRAM: https://t.me/kvantorcom

Author: Al Muhaimin

my bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1977549

My ETH: 0xFa3aECe75c6fa68F2A7A2690e5080FE62F82ed42

Tidak ada komentar:

Posting Komentar